Over the past five years the average length of tenure of ownership has increased sharply, indicating that Australians have a lower propensity to sell properties. The average hold period, or the average length of tenure for a property, is simply the average difference between when a property is originally purchased and when it subsequently sells. The analysis of average ‘holding time’ provides an indication of how long people are likely to own their property prior to it being sold. Across the country, the average length of tenure has been increasing during recent years.

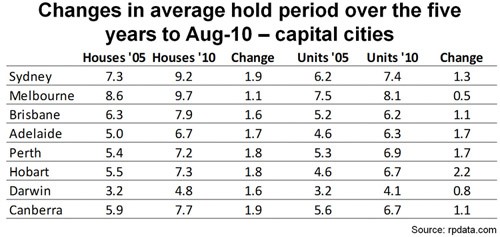

Between 2000 and 2005 the average holding time remained relatively flat at around 6.5 years for houses and six years for units. Since 2005 the average length of tenure has shown a consistent trend upwards. The reason for the reasonably steady average length of tenure between 2000 and 2005 is likely due to the fact that value growth was typically quite strong over the period and housing was more affordable than it currently is. As a result, there was greater market speculation in the market and property owners were prepared to sell on a more frequent basis. Over the year to August 2010, houses which sold had been owned for an average of 8.3 years whilst units had been owned for 7.2 years. Ten years prior, houses were being owned for an average of 6.8 years and units 6.2 years. Across each capital city the average length of tenure has increased over the past five years.